Tax Alpha: The “Tax Hack” to Minimize Capital Gains Taxes

A tax optimization strategy for investors facing substantial capital gains that can materially reduce or eliminate tax capital gains.

Are you expecting a large capital gains tax bill?

If you are a:

Investors with $1M+ in liquid assets.

Founders post-exit or approaching liquidity.

Concentrated stockholders facing diversification needs.

High-net-worth individuals seeking to minimize capital gains taxes.

You may be facing a familiar situation like:

Large realized gains from stock, crypto, or business sale.

Large unrealized gains in assets you want to sell, but for fear of getting a tax bill.

Most investors think their capital gains tax bill is unavoidable. It's not.

The Lumida Tax Shield uses quantitative strategies to mitigate tax. The strategy uses an algorithm to generate tax loss harvests.

These strategies go beyond basic tax-loss harvesting or direct indexing.

They are new services offered by institutional service providers that already manage tens of billions of dollars for investment advisors such as Quantinno and AQR.

Lumida focuses on identifying the best players in the category, then selects and configures the solution for your needs.

The algorithm keeps you fully invested in the market while systematically harvesting tax losses from normal portfolio volatility.

Here's the key: those "losses" aren't actually net economic losses; they're tax credits that directly offset your capital gains bill.

It's one of the rare situations where a loss on paper creates real economic value.

How the Lumida Tax Shield Works?

Generate Tax Assets

The algorithm runs a 130/30 long-short strategy, holding long positions in strong stocks while simultaneously shorting positions the model expects to underperform.

If the short positions decline, the strategy realizes a tax loss while your long positions continue to grow.

This systematic process converts normal market volatility into usable tax credits without disrupting your overall market exposure.

Offset Capital Gain Taxes

These tax assets offset capital gains from stock sales, crypto, real estate, or business exits.

If you don't need them immediately, they carry forward indefinitely under current tax law.

You stay fully invested in the market while building a reservoir of tax offsets that are far more efficient than simply holding a traditional index fund.

What is Tax Aware 130/30 Investing?

Think of it like this: The algo buys stocks it expects to out-perform, and hedges with stocks it expects to decline.

When those losing bets decline in value (as planned), you harvest a tax write off. Meanwhile, your winning positions continue to grow.

You can stay fully invested in the market while automatically generating tax savings from normal market movements.

How Does This Strategy Perform Versus The S&P 500?

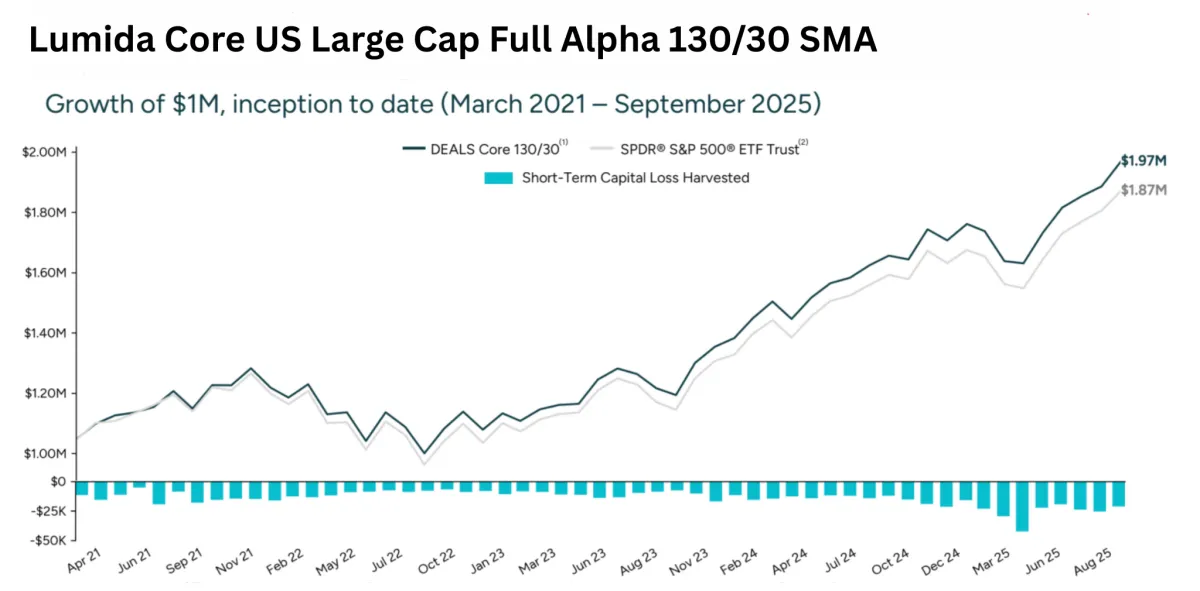

This chart shows the performance of $1M invested in Lumida’s Core US Large Cap Full Alpha 130/30 SMA.

Notice how it grew to $1.97M versus ~$1.87M for the S&P 500 from March 2021 to September 2025.

The blue bars highlight ongoing short-term loss harvesting, demonstrating how the strategy seeks market outperformance and a steady stream of tax loss harvests.

What Makes Lumida Tax Shield So Unique?

We specialize in long/short tax-loss harvesting SMAs, including 130/30 structures, designed specifically for taxable investors.

We build fully customized portfolios around each client’s needs, then power them with nimble, scalable technology that can systematically harvest losses while managing risk.

Our process is focused on sustainable, risk-controlled tax optimization rather than one-off trades, and we can implement it across a range of different account sizes.

We also offer flexible funding options and lower minimums so more investors can access this level of tax and portfolio engineering.

Show Me Performance and How Much I Would Have Saved In Taxes?

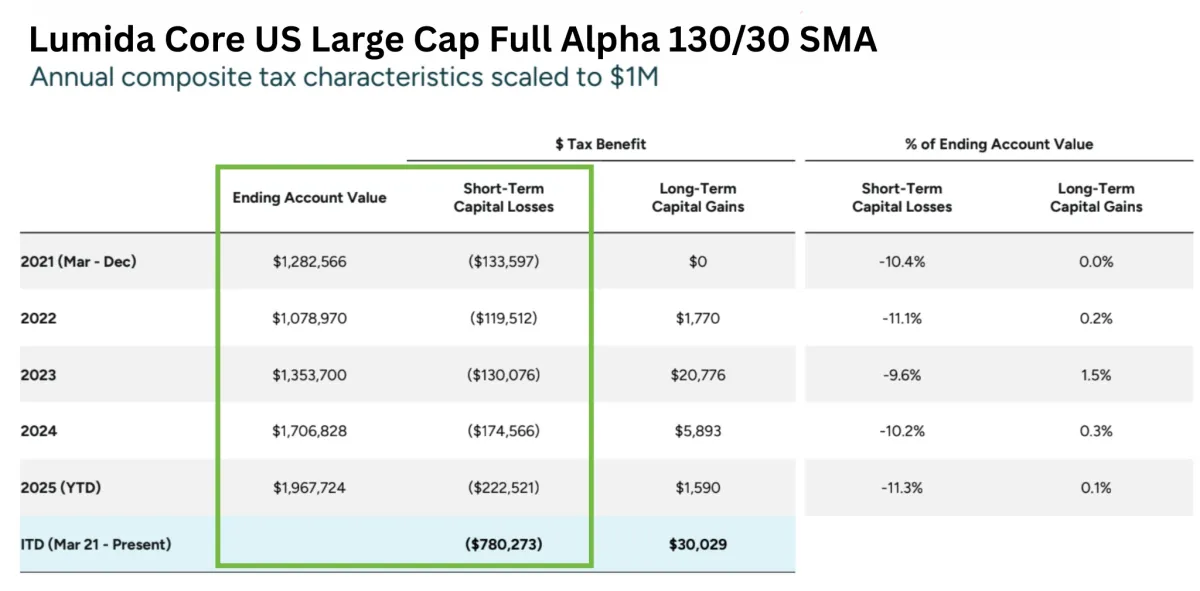

This table shows our Core US Large Cap Full Alpha 130/30 SMA, scaled to a $1M starting account. Since March 2021, the ending value has risen to about $1.97M while we have realized roughly $780K of short-term capital losses and only about $30K of long-term capital gains.

Our institutional algorithm providers who manages tens of billions using this strategy, grows the portfolio while systematically creating tax losses you can use to offset gains elsewhere, instead of triggering large taxable gains.

How Does This Model Know What To Buy And Sell?

This model scores each stock on value, momentum, quality, and proprietary signals.

The algo turns those scores into active weights versus the benchmark: high-scoring names we overweight and own long, low-scoring names we underweight or short.

That’s how the system decides what to buy more of, what to trim, and what to bet against.

How To Get Started?

Step 1: Open Your Account: Set up a dedicated account in your name at Charles Schwab.

Step 2: Delegate Trading Authority: Grant limited trading authority to Lumida to execute the strategy on your behalf.

Step 3: Algorithm Runs Automatically: The quantitative engine executes trades systematically to harvest tax losses while keeping you invested.

Step 4: Maintain Full Control: You retain complete transparency, can monitor performance anytime, and can unwind whenever you choose.

Why the $1M Minimum (and Why $3M+ Is Optimal)

The Strategy Requires Scale

The algorithm relies on diversification and trading density, typically holding 100–200+ positions across the portfolio.

More positions create more opportunities to harvest tax losses while maintaining market exposure.

Below $1M, there aren't enough positions to consistently generate meaningful tax assets.

The $3M+ Sweet Spot

At $3M and above, the strategy reaches its full potential. In certain market conditions, year-one harvested losses have reached 30–40% of initial capital, meaning a $1M account could potentially generate $300–$400k in tax assets during the first year.

Results depend on market volatility, sector dispersion, and position count, but the math becomes increasingly compelling at higher asset levels.

Can I Completely Eliminate Capital Gains?

Paired with a thoughtful estate plan, your heirs may receive a step-up in cost basis.

Under current tax law, that step-up can turn years of tax deferral into permanent tax elimination, so neither you nor your heirs ever pay those deferred gains.

We can explain to you and your tax advisor how to implement this strategy.

Can I Fully Eliminate Taxes?

The primary benefit is tax deferral.

You're using harvested losses to reduce taxes today while pushing capital gains obligations into the future.

This preserves more capital for compounding, but the tax liability doesn't disappear on its own. It's a timing advantage, not a loophole.

Taxes deferred create value by allowing you to compound your wealth.

This strategy requires your capital to remain invested for an extended period. If you expect to liquidate the account in full, it's not the best strategy for you as you would need to pay taxes on your long positions that are in the gains.

The strategty is ideal for long-term investors that are compounding wealth and want index exposure. For example, if you are invested in an index ETF, this strategy we believe will generate out-performance AND tax assets that can be used to offset any capital gain.

However, complete elimination of taxes requires coordination with an estate plan. We can talk to you and your Tax Advisor on how to set this up.

The Earlier You Start, The More You Save

Many tax strategies require implementation before year-end. Some need months to structure properly. The sooner you start, the more flexibility you have—and the greater the tax savings.

To maximize your 2025 tax benefits, your strategy must be in place before year-end.

With recent liquidity events, now is the time to act.

Don't let 40% of your gains go to taxes.

If you're sitting on $1M+ in appreciated assets and looking to neutralize capital gains through a legal, repeatable tax deferral framework, the next step is a discovery call.

Book Your Strategy Call

Ready to Explore a More Tax-Efficient Path Forward?

Schedule a confidential consultation with the Lumida team.

Tax Shield – Discovery Form

We help founders, investors, and executives keep more of what they’ve earned.

Why Lumida?

Lumida is a SEC Registered Investment Adivosr.

Our mission is to combine the best of investmenting with the best of tax and estate planning and deliver it in a modern digitally-native experience.

Our firm is venture-backed by leading investors including SEC Chair Arthur Levitt. Our CEO is recognized in the investment community and has written op-eds in the Wall Street Journal, The American Banker and has presented at leading industry conferences.

Our team shares the same mindset as our clients — curious, original, and driven to build what doesn’t yet exist.Recognized for our non-consensus insights, Lumida enables its clients to grow and invest beyond the ordinary.

.

Frequently Asked Questions

Answers to Your Key Tax Questions for Better Financial Health

How does this differ from traditional indexing?

Traditional indexing is built to simply track the market and typically realizes limited losses, so there may not be enough to offset your gains. Lumida’s 130/30 tax-aware strategy actively trades within a diversified, S&P-like framework to generate significantly more usable tax losses—often many times higher than a plain index portfolio—while seeking to stay close to broad-market risk.

What if I need to access my money?

Lumida designs this approach for long-term, taxable capital. You can withdraw, but if you expect to need a large portion of the assets in the near term, this Lumida strategy may not be the right fit.

Can I lose money?

Yes. With Lumida’s strategy you remain fully invested in equities, so your portfolio will rise and fall with the market, and you may lose money. The portfolio is designed to approximately track the S&P 500, but it is active and does not guarantee returns or protect principal.

What happens if I sell the entire portfolio?

You can unwind your Lumida portfolio at any time. However, selling all positions will realize any embedded gains, which may create a tax bill; the strategy works best when capital stays invested so losses can be harvested and compounded over time.

How do I get started?

Schedule a consultation with a Lumida tax and investment specialist. We will review your current holdings, projected gains, time horizon, and objectives, then determine whether this strategy fits your situation and coordinate with your tax advisor as needed.

Important Disclosures

Lumida Wealth is an SEC-registered investment advisor. Lumida Tax Shield strategies are complex investment approaches that involve risks, including loss of principal. Tax-loss harvesting strategies do not guarantee tax benefits, and individual results will vary based on specific circumstances. Past performance is not indicative of future results.

This material is for informational purposes only and does not constitute tax, legal, or investment advice. Consult with your own tax, legal, and financial advisors before making any investment decisions.

Important: The 130/30 strategy involves leverage and short positions, which carry additional risks. Investors should carefully review all disclosures and offering materials before investing.

Lumida works with institutionally algorithim providers such as AQR and Quantinno to implement these benefits via a separately managed account.

For complete disclosures, performance information, and risk factors, please contact us directly.