Earn Cash Yield From Off-Grid Bitcoin Mining

Generate enhanced income from Bitcoin mining powered by excess natural gas

Generate Cash Yield From Off-Grid Bitcoin Mining

Unlike holding Bitcoin and enduring the volatility, Bitcoin mining can be a direct source of cash flow.

When Bitcoin is mined at a low and stable energy cost, it can also generate cash.

This approach earns yield by producing Bitcoin cheaply using excess natural gas.

The operating profits are then distributed to generate yield for investors.

The yield typically ranges around 15 to 25%. Sometimes, the strategy produces a yield of 30%+.

The yield is on the price of Bitcoin above the cost of producing bitcoin (around $40,000 when using excess natural gas).

The goal is simple: reliable, distributable cash, not speculative paper gains.

To execute on this objective with discipline, Lumida has expertise in digital assets and private markets across market cycles.

Lumida is an SEC-registered investment advisor.

Lumida’s CEO invests capital alongside clients, ensuring alignment.

How the Cash Is Generated

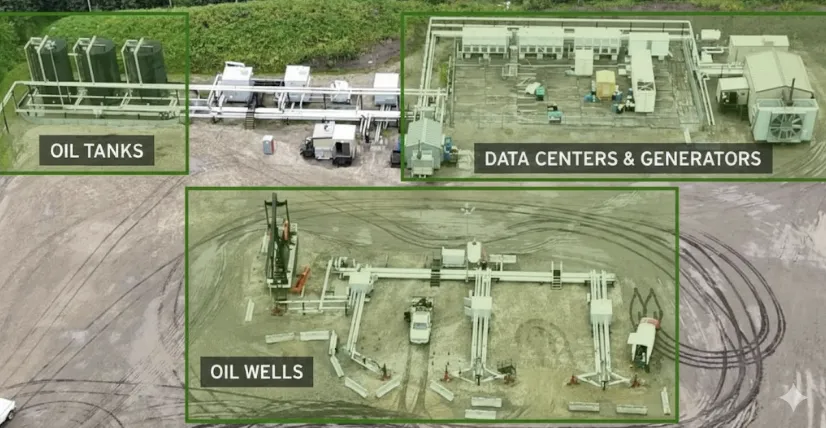

Off-grid Bitcoin mining produces electricity directly at the energy source rather than buying power from the grid.

This model uses excess natural gas from oil & gas wells that would otherwise be flared or wasted

Natural gas is expensive to transport without a pipeline - and there are thousands of wells that are not using natural gas productively.

That’s where our operating partners step in.

Lumida identifies operators that can acquire access to natural gas.

These operators install on-site generators that convert the gas into electricity.

The electricity powers data center systems that mine Bitcoin.

By using excess or "stranded" natural gas (which would otherwise be wasted or flared) as a nearly zero-cost fuel source, the off-grid mining operation can produce Bitcoin significantly cheaper than traditional, grid-dependent miners.

Bitcoin is produced consistently and reliably, and then sold - along with the underlying oil - to generate yield.

Why Cheap Energy is Crucial to Bitcoin Mining

Electricity is typically 60-80% of bitcoin mining cost, and grid unit prices are rising.

On top of that, transmission hurdles add uncertainty, and curtailment affects uptime.

Off-grid mining removes these variables.

Fuel costs are structurally low. Power pricing is stable and insulated from grid volatility.

Companies using the ‘flared-gas’ model can mine a BTC at less than $45,000 compared to $80,000+ at grid electricity.

Cheap Energy Comes from Excess Natural Gas

Natural gas is dissolved into oil products.

When you extract oil, natural gas is released and often generated as an excess product.

Ideally, the gas is transported using pipelines to nearest power generation plants.

However, not all oil and gas wells have access to these pipelines.

There are thousands of wells with remote operations that are not attached to any pipeline.

When wells are remote and not attached to a pipeline, the most common (and economically simplest) alternative is flaring.

Flaring is the controlled burning of the excess natural gas.

Flaring allows oil and gas producers to continue operations.

However, flaring is harmful for the environment. Regulations often limit how much natural gas can be flared.

When a well produces excessive natural gas, and flaring limits don’t allow further burning, the owner has no choice but to leave the well stranded.

Bitcoin Mining is the Solution to Excess Natural Gas

The excess natural gas is put to work with on-site generators, producing electricity.

These electricity powers on-site datacenters to mine Bitcoin.

Electricity is produced on the site, and used immediately. There is no need for a pipeline. It gets better.

The excess oil is also sold for additional revenues. That creates two sources of revenue.

What is the cost of energy?

The cost of natural energy is essentially zero using the stranded gas model.

There are costs to attach generators and provide on-going servicing.

This is how a data center looks.

The datacenter is a modular, on-site structure that houses the specialized computer equipment.

These ASIC miners are necessary to convert the electricity produced by the natural gas generators into new Bitcoin.

It is the secure and climate-controlled operational hub where the mining actually takes place.

Datacenters require periodic investments for maintenance and replacements.

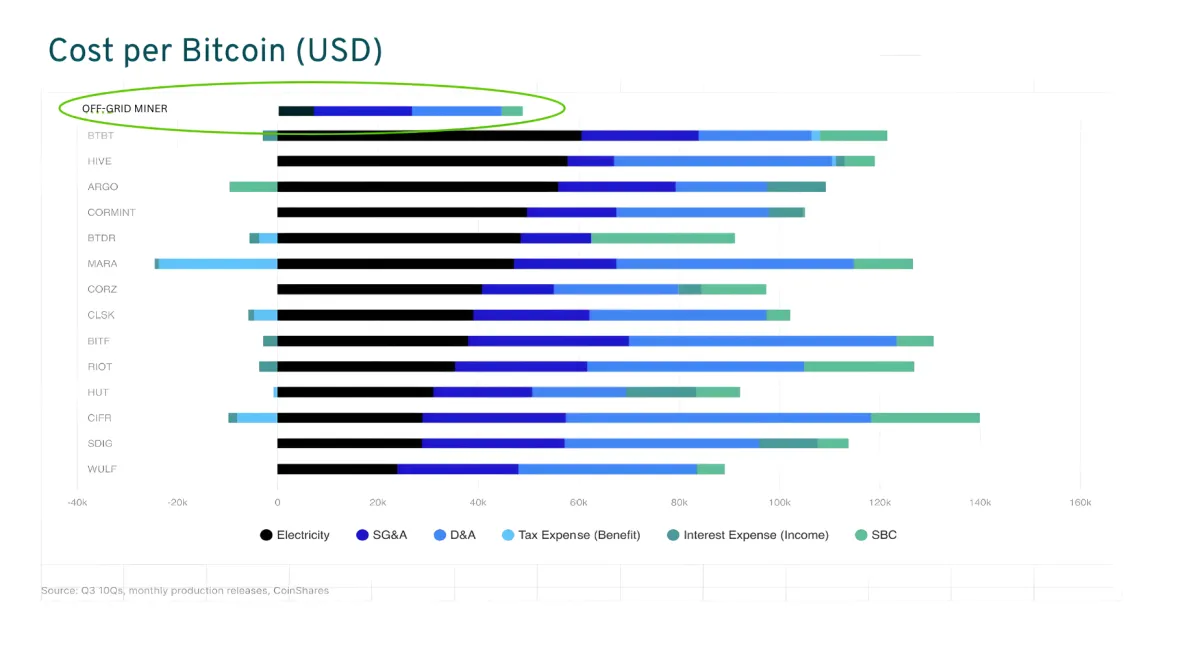

Here is the cost per bitcoin for selective miners - Lumida operators use the stranded gas model, and achieve a $45K cost per bitcoin.

Other operators have cost/bitcoin higher than $80K.

As Bitcoin prices drop, unprofitable miners exit the market.

That creates more opportunity for the strategy as due to effectively zero energy costs.

Off-Grid Miners Have The Cost ‘Edge’

This idea is proven by companies like Crusoe Energy.

Crusoe Energy built its business by converting flared natural gas into compute power, initially for Bitcoin mining and now for OpenAI’s workloads.

Crusoe was a pioneer in the off-grid bitcoin mining space.

They convert wasted natural gas into power for computers such as Open AI.

Crusoe started by mining Bitcoin and then grew into large-scale AI work, proving this off-grid method can reliably run serious, industrial computing operations.

While Crusoe Energy is a pioneer, Lumida partners with a network of other proven, off-grid energy operators.

Our operators reliably convert wasted natural gas into power for Bitcoin mining. This ensures low costs and consistent operation for our projects.

How Investors Are Paid

Your investment is designed to generate cash yield through a “Net Profit Interest”

Net Profit Interest: You invest in a specific mining project. The cash flow from that project is first used to pay back your original investment. Once your capital is fully returned, you then begin to share in the ongoing profits.

Bitcoin production is converted into cash distributions.

"A new project can take one to two quarters to fully launch and reach consistent production. After this ramp-up period, the cash is paid out quarterly.

How is it Taxed

The initial cash flows are treated as a return of principal, meaning you get your original investment back first.

This payment is not taxed as capital gains or income.

After your full principal is returned, you then begin to receive interest income.

Our team helps you structure the returns for maximum tax efficiency.

What’s Our Role?

Lumida sources private off-grid Bitcoin mining investments with a focus on cash yield, capital recovery, and downside control.

We work only with proven operators who have demonstrated the ability to run off-grid energy and mining infrastructure profitably at scale.

We pass on the majority of opportunities we review.

Our Founder invests personal capital alongside investors, ensuring full alignment and real downside exposure.

Each project is underwritten independently based on energy economics, miner equipment, well life, historical uptime, and sensitivity to Bitcoin price and network difficulty.

The objective is to produce reliable, distributable cash flows with disciplined risk management.

Lumida is well known in the Digital Assets space and has featured in:

Who This Is For

This is for accredited investors and qualified purchasers who want cash yield from Bitcoin production without leverage, lending, or token-based returns.

It is not designed for trading or speculation.

What happens when the price of bitcoin falls?

When the price of Bitcoin falls, less efficient miners become unprofitable and stop operating. Less miners mean lesser competition on the network, reducing mining difficulty. This enables remaining bitcoin miners to mine more bitcoins with existing energy input. Therefore, despite the lower price, the profitability stays intact.

Are there other sources of yield?

Yes. The oil produced during the operations provides an additional revenue stream. Similarly, some states also have environmental incentive programs, which provide carbon credits for off-grid miners.

What is the typical life of an oil well?

The typical life of an oil well is ~20 years.

What are the risks?

The biggest risk is that bitcoin mining is deemed illegal in the United States, Canada or in other markets where we find opportunities or, that the price of bitcoin and oil crash to low levels and remain at low levels for an extended period of time. During Covid, oil prices and bitcoin did drop to levels where it is uneconomical to mine.

However, our view is that the markets self-correct as supply goes offline and prices naturally recover.

How easy is it to mine bitcoin offgrid?

Operating a bitcoin miner powered by gas linked to an oil well is a complex operation. If a generator is offline or gas is not delivered, you are not mining and that represents lost revenue. Special skills, investments and supervision are required to successfully execute the strategy.

What is the return and cashflow expectation?

Off grid bitcoin mining is still a relatively new asset class.

The novelty of the asset class plays a role in creating returns that are sometimes over 20%.

As more capital enters the asset class, over time the returns to the strategy will decline.

The wells we acquire often have lifespans of 10 to 20 years. That’s 10 to 20 years of cashflow.

We will provide an estimate of how long it takes to get a full principal return. Often the estimate is 2 to 3 years, although it can vary by deal. We have deal history we can share with you.

Limited Access: Private Off-Grid Bitcoin Mining Investments

Sign up here to get a call from our team

Disclaimer

Important Information

LUMIDA DEALS: For qualified investors seeking to diversify their portfolios and potentially enhance returns.

Past performance does not guarantee future results. Investments involve risks.

OUR EDGE: Deal Access refers to the availability of private market investments and does not imply any guarantee of performance or returns. The term "Non-consensus" investments does not imply any guarantee of future performance

OUR DEALS: The content provided on or through the site may include information regarding past and/or present portfolio companies or investments managed by Lumida, its affiliates and/or its personnel. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. Further, references to past and present portfolio companies should not be construed as a recommendation of any particular investment or security. Any current and previous portfolio companies listed on the site may not be a complete list of all investments historically made by Lumida. The portfolio companies listed should not be assumed to have been profitable. Any past performance information on the site is not necessarily indicative, or a guarantee, of future results. Industry market size estimates can vary and may change over time.Lumida cannot independently verify the terms or existence of other parties' investments. For comprehensive information about this investment and associated risks, please reach out to us.Investing in private markets carries risks, including potential loss of principal. Past performance does not guarantee future results. The investments discussed have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission.

Lumida Form: This form is for informational purposes only. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Filling out this form does not commit you to any investment.

Lumida's Investors: The individuals and entities featured on this section in the page are investors in Lumida Wealth. Their inclusion does not constitute an endorsement or recommendation of Lumida or its services. These investors have a financial interest in the company and may benefit from an increase in the company's value.These individuals and entities may have interests in other ventures unrelated to Lumida Wealth.

Lumida Wealth Management LLC (‘Lumida”) is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida's website (referred to herein as the "Website") is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of the Website on the Internet should not be construed by any client and/or prospective client Lumida’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This is not an offer to sell or a solicitation of an offer to buy any security. Such offers can only be made through official offering documents that contain important information about risks, fees, and expenses. Investors should conduct their own due diligence and consult with a financial advisor before making any investment decisions.

Lumida Wealth Management, LLC is a registered investment advisor. More information about the firm can be found in its Form ADV on file with the SEC.